Atrium® is an AI-powered intelligence platform built for investors, analysts, and bankers who need to move fast. We unify bank filings and real estate lending data to deliver real-time insights at the loan level — helping you assess credit risk, trace CRE and multifamily exposure, benchmark peers, and uncover market-moving developments in minutes.

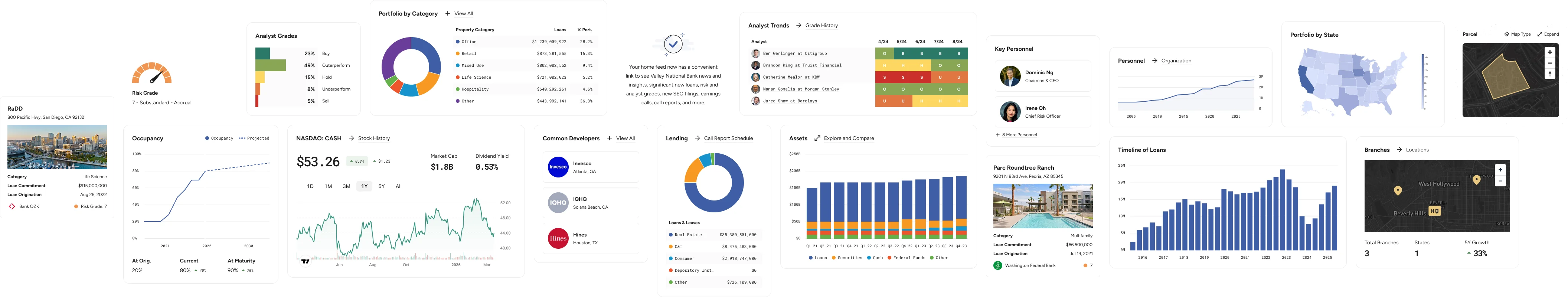

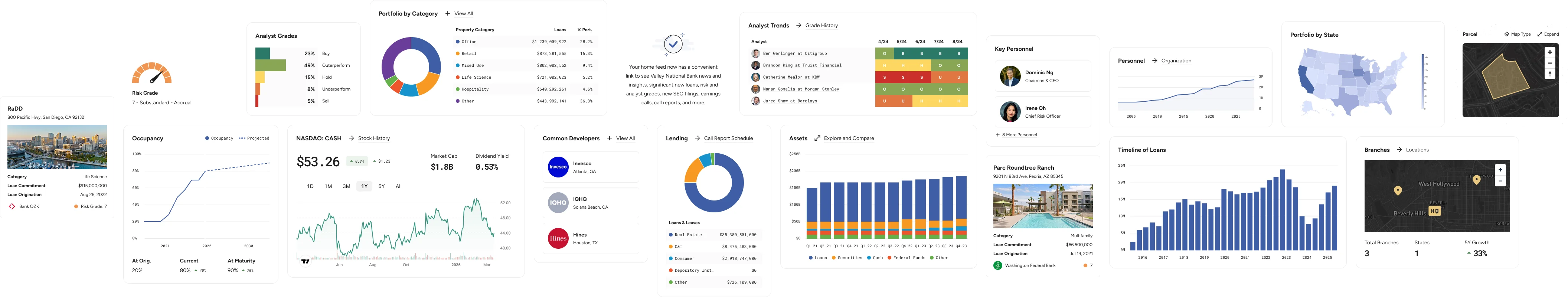

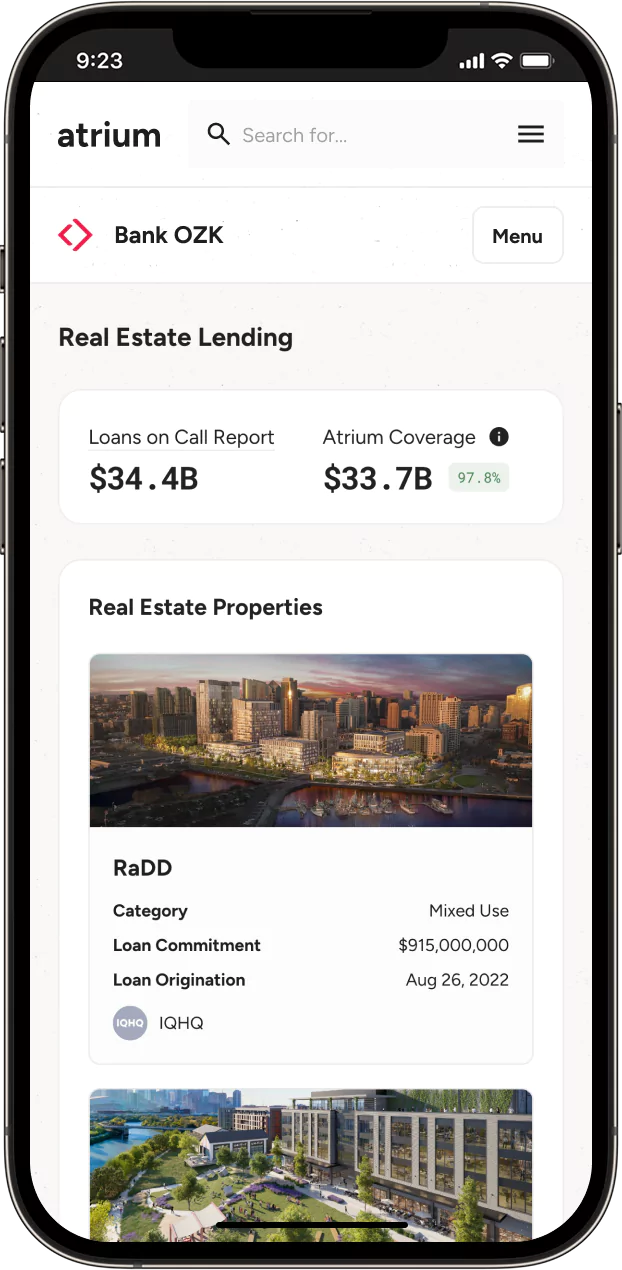

Real estate lending analytics

Atrium transforms raw mortgage filings into investor-grade intelligence — matching county records with internal data to reveal where banks are lending, to whom, and on what terms. Gain visibility into CRE exposures, complete with property details, LTVs, filing history, and ownership profiles. Understand borrower behavior, spot concentrated risks, and underwrite the balance sheet behind every loan.

Features investors love

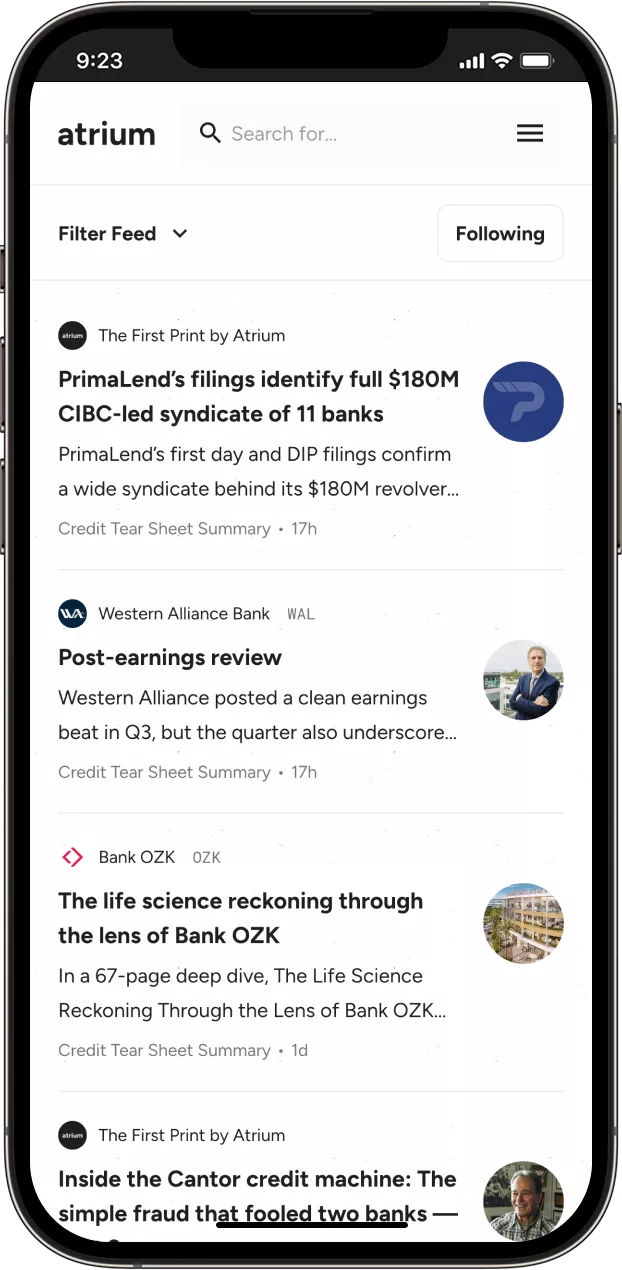

Atrium's AI surfaces high-conviction moves and loan-level signals — the day they emerge — so you can act on credit events as they happen, not when the bank tells you they happened! By connecting recorder books, court filings, and disclosures into a single, contextual feed, Atrium gives you the edge to act before the market moves.

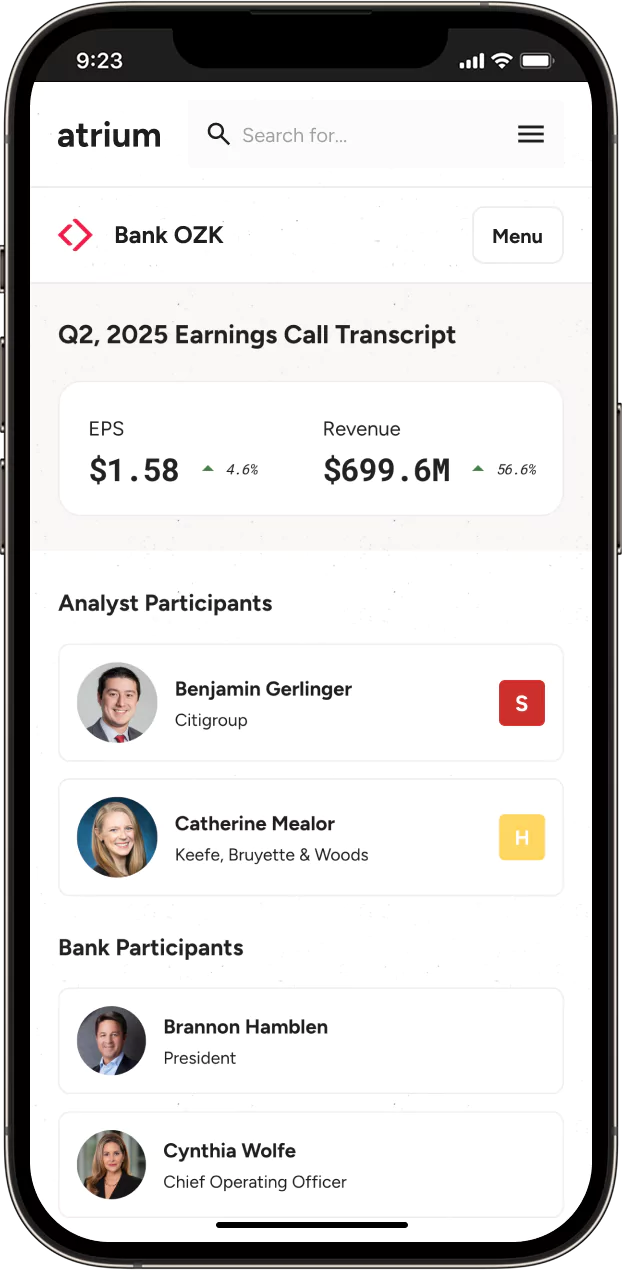

Stocks & transcripts

Atrium decodes bank earnings calls with full transcripts, audio, and insights into the participants. Analyst questions are mapped to their ratings so you can judge sentiment in real time. And our AI agents flag key metrics and highlight individual credit references — giving you early visibility into emerging risks and trends.

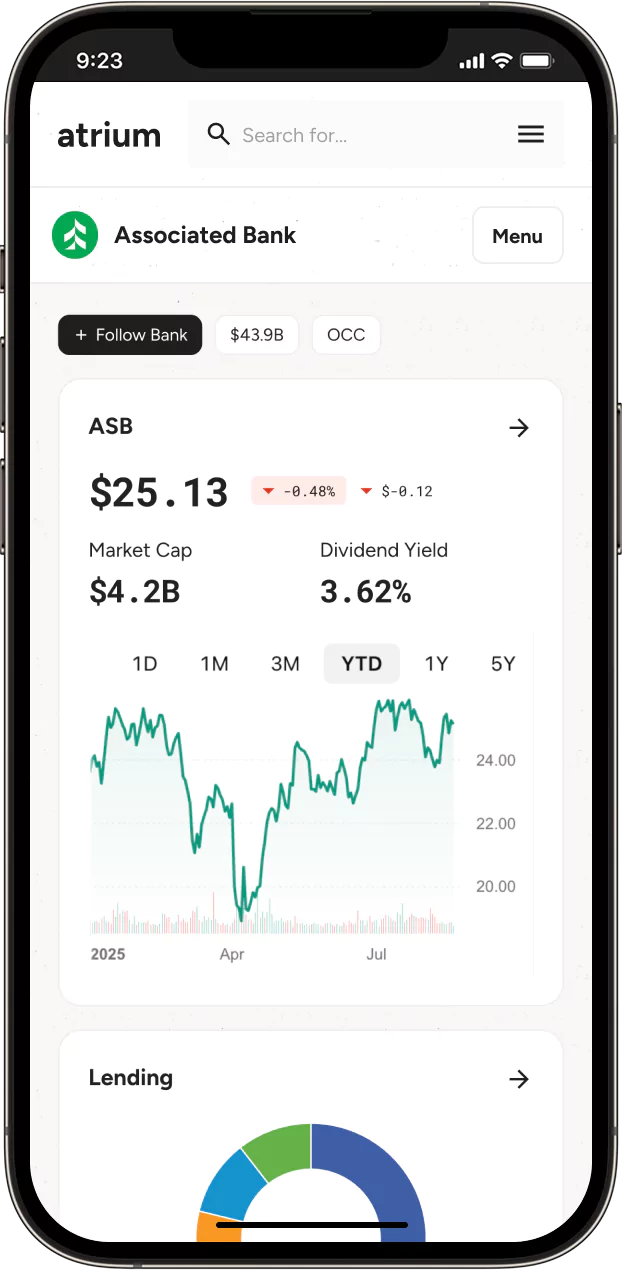

Financial data

Atrium unifies stock performance, call report schedules, UBPR metrics, and loan-level lending data in one intuitive platform. Move beyond raw tables with interactive charts, peer comparisons, and AI-generated insights that spotlight trends and risk in seconds — plus a tool to build custom charts — so you spend less time gathering data and more time making confident decisions.

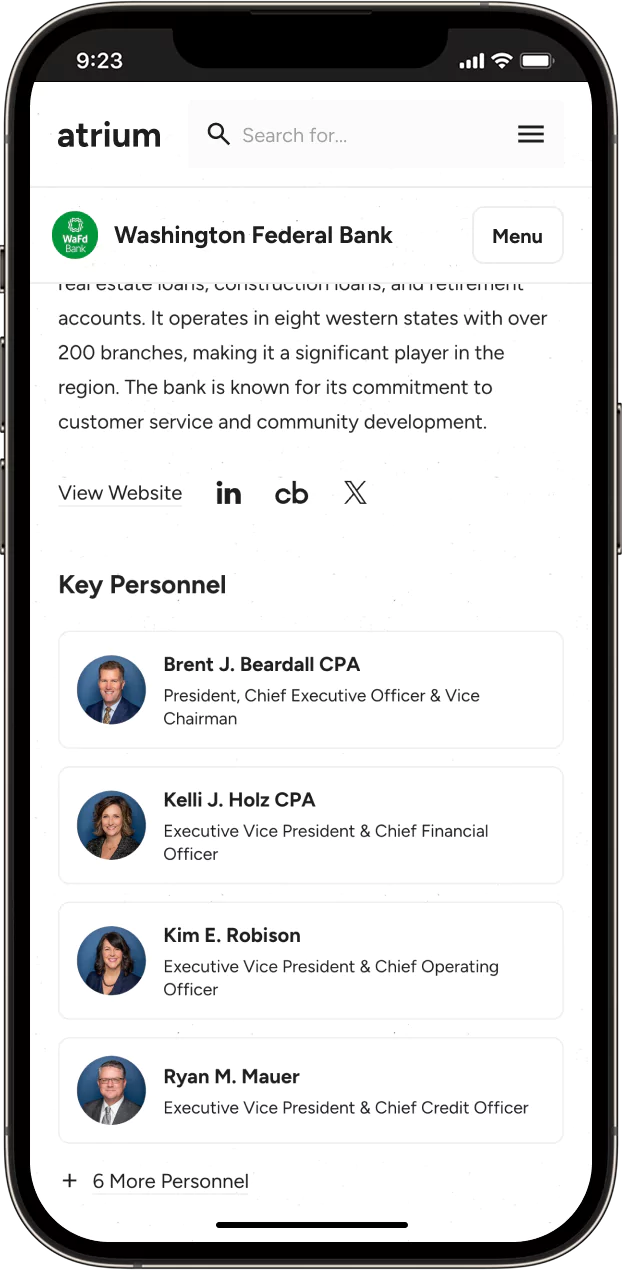

Find what you need, fast

Atrium gives you more than just financials. Get visibility into bank org charts, key personnel, branch growth, and entity structures — plus access to source documents like call reports, SEC filings, investor presentations, and property brochures. It's everything you need to understand how a bank is built, who's behind it, and what they're saying.